Not known Factual Statements About Personal Guarantee Lease

Security down payments can be a major worry on tenants, particularly startup lessees that might not have access to cash money they can offer to the property owner to hold for an extended period of time. When it is impractical (or impossible) to give the property owner sufficient safety and security with simply a security down payment, the parties will commonly think about a letter of credit report to either supplement or replace a safety and security down payment.

Basically, it is a down payment in the type of credit score advanced by a 3rd party establishment (usually a financial institution). Letters of credit scores can be found in two significant types, industrial and standby. For purposes of industrial leasing, we are talking just concerning the standby letter of credit score. The method the letter of credit jobs is that the lessee will go to its lender and also request a letter of credit rating in support of the proprietor.

If the financial institution chooses the lessee is creditworthy, after that the bank will offer a letter of credit scores guaranteeing the lessee. The letter of credit rating is normally essentially a letter signed by the bank that claims the financial institution will supply a specific quantity of cash to the property manager if the landlord contacts the bank as well as certifies that the lessee is in default.

Letters of credit history are usually bargained, both in between the property owner and tenant and also between the tenant and the bank. Among the significant problems is whether the property owner will need to give any evidence of real lease default prior to the financial institution is needed to pay on the letter of credit report.

Some Of Breaking Commercial Lease Personal Guarantee

As well as the tenant would certainly choose the financial institution ask questions before handing over the cash. You ought to understand what your proprietor has to perform in order to obtain accessibility to the letter of credit scores, consisting of whether the property manager has to initially seek payment from various other resources. Likewise, due to the fact that a letter of debt can be expensive (generally a few percent of the equilibrium annually just to keep the letter effective), the tenant will wish to consider replacing the letter of credit score as quickly as the property owner agrees to let it go.

A letter of credit scores can be a really helpful device for property owners as well as occupants to endanger regarding creditworthiness, and also they are made use of often, particularly in bigger transactions where the cost of the letter of credit score is extra quickly taken in. You need to understand whether a letter of debt will profit you, what other alternatives could be available, as well as the particular regards to the letter of credit report, before accepting supply one.

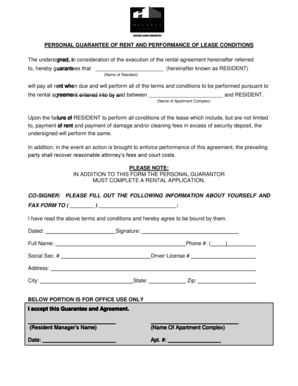

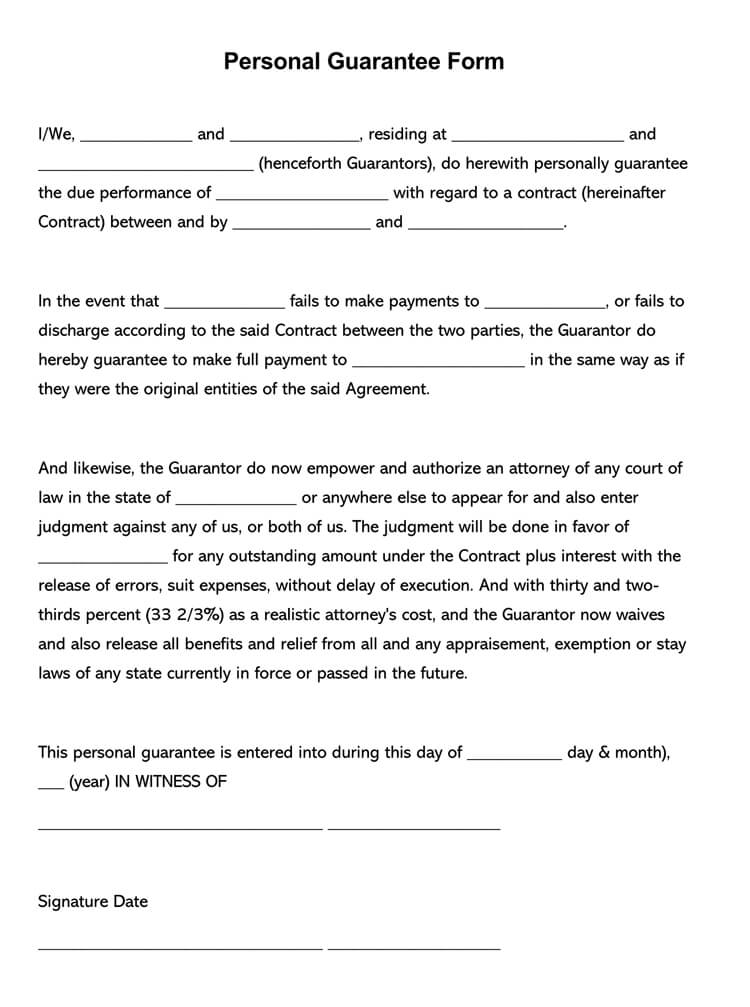

A personal guarantee (alternatively composed as "personal guaranty") is another usual kind of credit enhancement. It is a guarantee by several people that a 3rd party tenant (normally the restricted responsibility entity through which the individuals are negotiating business) will pay according to the terms of the lease.

A personal guarantee can be an effective kind of debt improvement and is an additional tool made use of to supplement (yet typically not change) a safety deposit. Individual warranties prevail when the lessee is a limited obligation entity, such as an LLC, without a recognized operating background as well as without considerable assets - personal guarantee commercial lease.

The 20-Second Trick For How To Get Out Of A Personal Guarantee On A Commercial Lease

Due to the fact that of this, proprietors will usually need that limited responsibility entity proprietors personally assure the lease commitments. The personal warranty resembles the letter of credit because it offers the landlord much more assurance of being paid in case the lessee is not able or resistant to install a big enough down payment to make the landlord comfortable.

The terms of an individual guarantee commonly vary, as well as the extra greatly negotiated terms surround whether the property manager needs to first seek the tenant prior to pursuing the individual guarantor. Typically, the property manager wants the choice to pursue the personal guarantor without having already pursued the lessee, where an individual guarantor wants the contrary.

You should fully comprehend the personal warranty prior to finalizing, as authorizing a personal assurance dramatically undermines the purpose of having a restricted liability entity as well as subjects the individual guarantor to considerable personal threat. personal guarantee lease. Image: p_d_s Flickr Gideon has actually fly fished for trout in rivers on 3 continents.

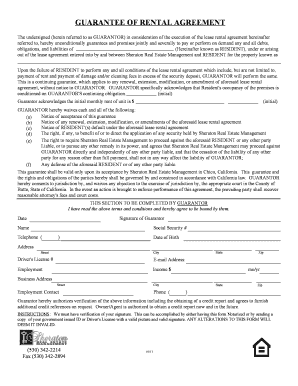

Show information Hide details ARRANGEMENT OF PERSONAL WARRANTY ATTACHED TO As Well As MADE COMPONENT OF THE LEASE ARRANGEMENT DATED 20 BETWEEN PROPERTY MANAGER As Well As TENANT The witnessed Guarantor in consideration of the making of the foregoing Lease Arrangement between Renter and Landlord does hereby unconditionally ensure the repayment of the lease by the Renter and also the performance by Renter of all the financial tasks and also commitments under the Lease Agreement.

Some Known Details About Personal Guarantee Lease

In my 35 years of experience as a local business owner as well as lease arbitrator for company America as well as little business proprietors, one of the most usual component for a lot of local business proprietors when authorizing a lease is the individual warranty vs. a business warranty for large firms. I'm often asked by local business owner if the individual guaranty can be omitted when signing a lease. personal guarantee commercial lease.

There are a couple of exemptions when a commercial proprietor will certainly approve a letter of credit history or various other substantial security instead of the guaranty, but 99% of the moment, a personal guaranty can not be prevented. There are several factors for this need (personal guarantee commercial lease). First, the property owner desires guarantees the lease responsibilities will be fulfilled by the company proprietor, and as an incentive, they want the lease backed by the personal guaranty, therefore, making it harder for business owner to merely stroll away from the lease if the organisation is refraining from doing well or along with anticipated.

There are, nevertheless, some techniques to work out these personal assurances that can be utilized in renting transactions. One of the most recommended method is to use a minimal or rolling warranty. These methods are often acceptable to proprietors, relying on the company owners' credit rating, financial photo and company experience. The stronger the qualifications, the better odds of having the ability to bargain.

click over here now